How Chapter 13 Discharge Papers can Save You Time, Stress, and Money.

Table of ContentsHow To Obtain Bankruptcy Discharge Letter - TruthsThe Only Guide to How Do I Get A Copy Of Bankruptcy Discharge PapersThe Ultimate Guide To Chapter 13 Discharge PapersFascination About How Do I Get A Copy Of Bankruptcy Discharge PapersChapter 13 Discharge Papers for DummiesAn Unbiased View of How To Get Copy Of Chapter 13 Discharge Papers

Among the reasons individuals submit personal bankruptcy is to obtain a "discharge." A discharge is a court order which specifies that you do not have to pay a lot of your financial obligations. Some financial obligations can not be discharged. For instance, you can not discharge debts for most tax obligations; youngster assistance; alimony; a lot of pupil financings; court penalties as well as criminal restitution; as well as injury brought on by driving intoxicated or drunk of drugs.

You can just receive a chapter 7 discharge once every eight years. Other regulations might use if you previously received a discharge in a chapter 13 instance. No one can make you pay a financial debt that has been discharged, yet you can willingly pay any type of debt you desire to pay.

Rumored Buzz on How Do You Get A Copy Of Your Bankruptcy Discharge Papers

Some lenders hold a safeguarded case (for instance, the financial institution that holds the mortgage on your house or the lender that has a lien on your auto). You do not have to pay a secured claim if the financial obligation is discharged, however the lender can still take the property.

If you are a private as well as you are not stood for by a lawyer, the court must hold a hearing to choose whether to authorize the reaffirmation arrangement. The arrangement will not be legally binding up until the court authorizes it. If you declare a debt as well as after that fall short to pay it, you owe the debt the same as though there was no insolvency - https://medium.com/@b4nkrvptcydcp/about.

More About Bankruptcy Discharge Paperwork

The lender can likewise take lawsuit to recoup a judgment versus you - like it https://www.businessnewsplace.com/author/b4nkrvptcydcp/. Revised 10/05.

To request court records online, please full the kind listed below (http://dugoutmugs01.unblog.fr/2022/07/12/the-best-guide-to-copy-of-bankruptcy-discharge/). If you are requesting to review court documents at the courthouse, you will certainly be contacted when the instance data is readily available to examine. If you are requesting to acquire copies of court documents, you will certainly be called with cost and also a shipment time estimate.

Do NOT send your social safety and security number, financial institution or bank card information via this website. The clerk can not guarantee the safety and security of details or records sent out through this website. Furthermore, any kind of correspondence, documents, or documents sent out to the staff through this site may be disclosed in accordance with Florida's Public Records Regulation.

Excitement About Obtaining Copy Of Bankruptcy Discharge Papers

A Chapter 13 insolvency discharge is a really powerful thing. It quits your creditors from pursuing released financial debts permanently. It can also be confusing. Let's respond to several of the usual inquiries regarding the Chapter 13 discharge. A "discharge" is the expensive lawful term for your debts being forgiven in your insolvency.

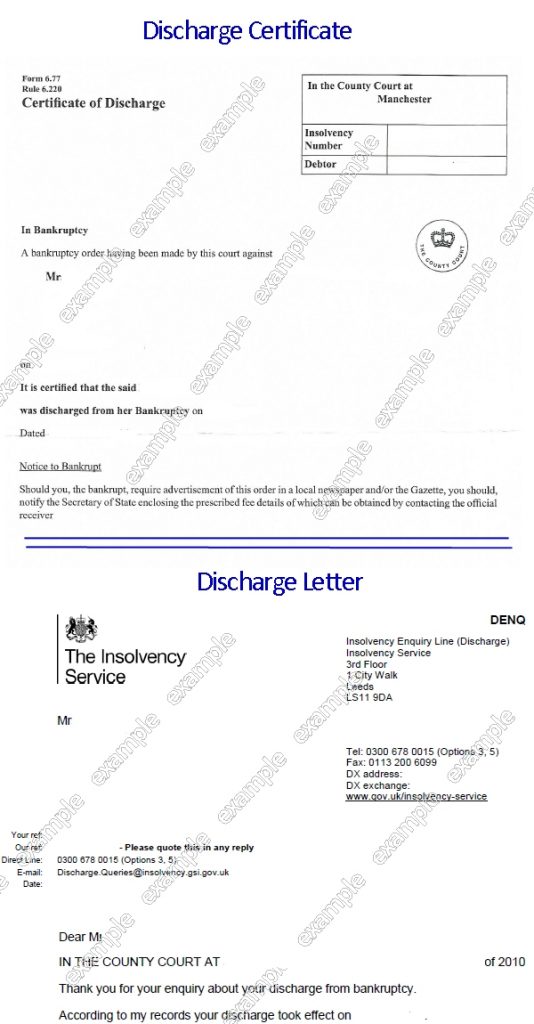

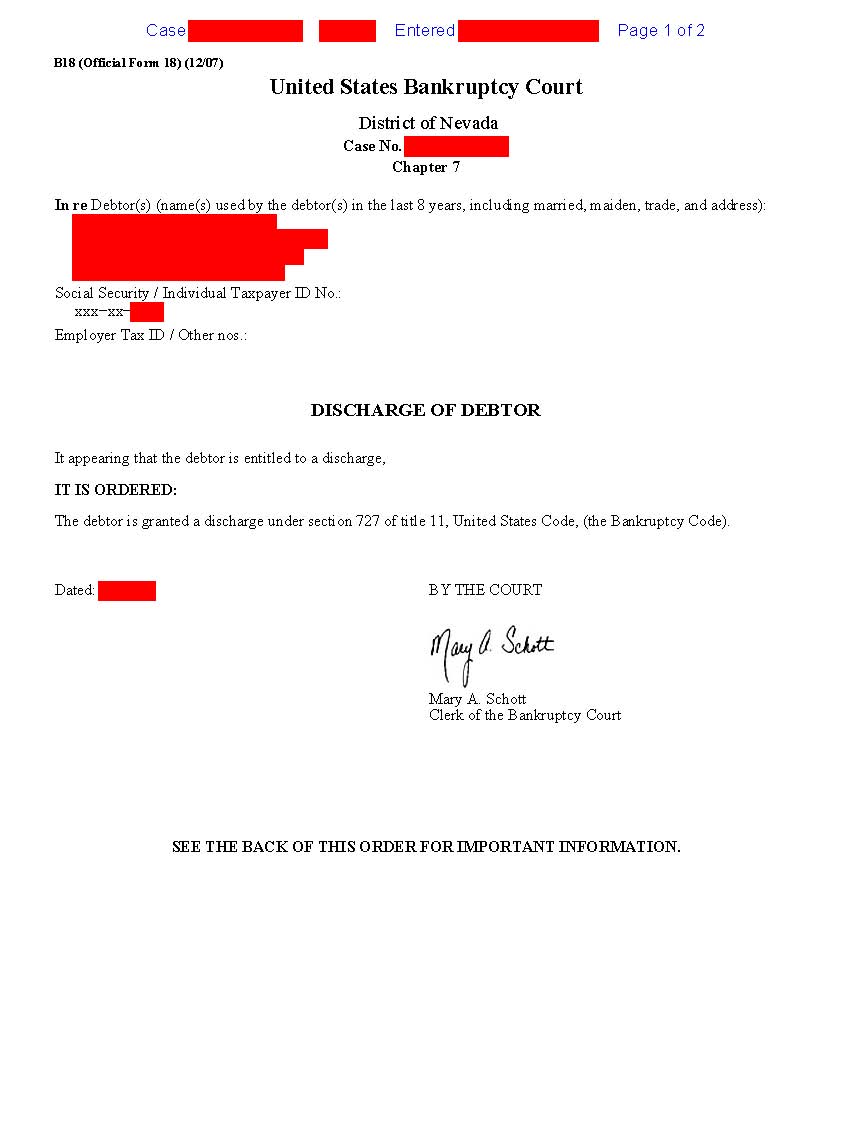

The Phase 13 "discharge order" is the final order you receive in your Chapter 13 insolvency. It is authorized by the personal bankruptcy judge designated to your cases and states plainly that you have actually received a Chapter 13 discharge. To put it simply, it is the official file that releases you of your financial debts.

We ought to keep in mind that there are two types of discharge under Phase 13. The second is called a "hardship discharge" and also is often called a Section 1328(b) discharge.

The Greatest Guide To Chapter 13 Discharge Papers

While every court is a little different, the Phase 13 discharge order looks comparable. As soon as you obtain your discharge, your creditors are "urged" from pursuing the financial obligation.

We commonly see this in instances where financial obligation collection firms proceed to send out repayment needs also though the person obtained the discharge. One of the biggest points regarding bankruptcy is that your financial debt is released tax complimentary - copy of chapter 7 discharge papers.

You would certainly need to pay tax obligation on any money forgiven by the financial obligation enthusiast. In bankruptcy, the discharge makes it to ensure that the financial debt forgiveness is not taxable. This occurs. It's an accounting problem for the financial institution. No worries though. You can simply complete an IRS Type 982 when you finish your income tax return to clarify you have a bankruptcy discharge.

The Of How To Get Copy Of Chapter 13 Discharge Papers

If we submit your tax obligations for you, we will do this for you so you do not have to stress over it. We review the timeline in the Chapter 13 personal bankruptcy process, yet normally, you will obtain the discharge boss 1-3 months after completing your Phase 13 plan settlements. The length of your Phase 13 strategy differs from situation to case.

Most debts are dischargeable in Phase 13 with a few exceptions. So we typically start by thinking the debt is dischargeable unless an exemption applies. The typical exemptions to dischargeability are: The Chapter 13 discharge is even more thorough than the Chapter 7 discharge. Much more financial debts are dischargeable in Phase 13 than in Phase 7.